Toronto’s real estate market has been going through a quieter phase, with sales slowing and prices cooling from the highs of recent years. For many, this has felt like a sharp contrast to the “golden era” of Toronto real estate, when homeownership seemed like a guaranteed wealth-building move.

But while the short-term headlines have been dominated by stalled sales and hesitant buyers, long-term projections still show Toronto home prices trending upward — a reminder that today’s slowdown may actually be tomorrow’s opportunity.

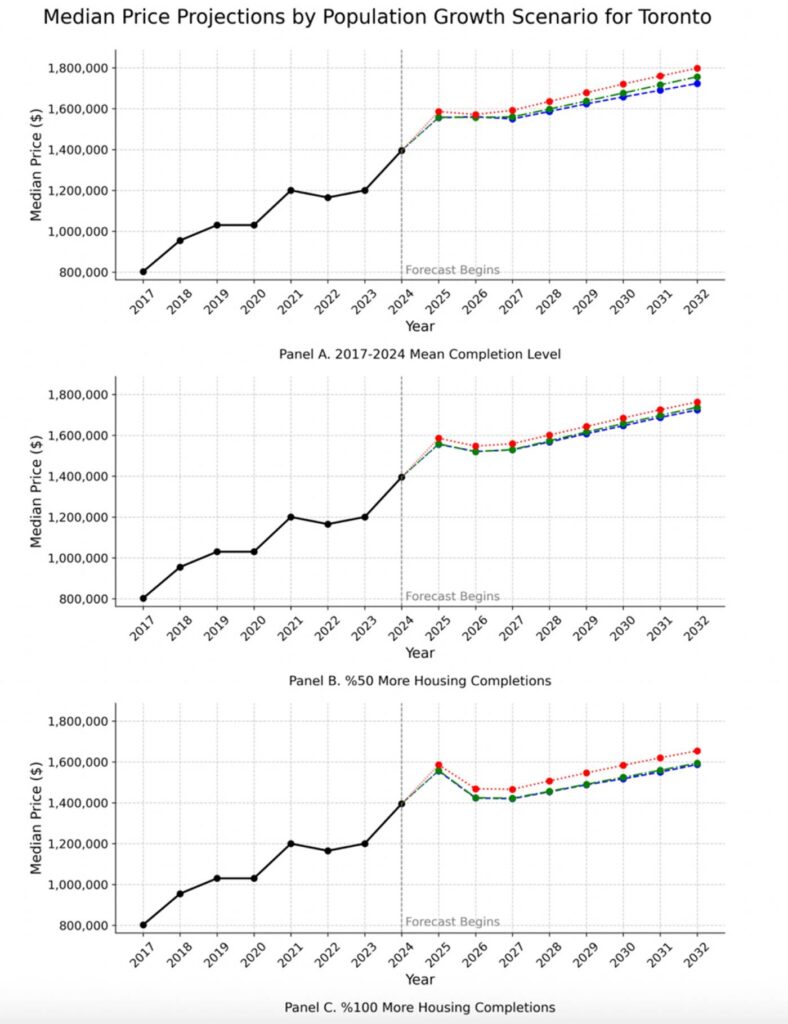

According to a study from Concordia University’s John Molson School of Business and private equity firm Equiton, Toronto’s median home price, now about $1.4 million, could climb to $1.8 million by 2032 if the pace of new housing completions continues at current levels.

That same research projects Vancouver’s median home price rising from $2.5 million to $2.8 million, and warns that only by doubling the pace of new construction could Toronto and Vancouver avoid runaway price growth.

Why Supply Matters — And Why Policy Shifts Are Critical

Led by Concordia professor Erkan Yönder, the study used a neural network-based AI model to analyze mountains of housing and policy data. The findings make one thing clear: Canada’s supply problem is at the heart of its affordability challenge.

Current pace: Completions are at just 1.75% of existing dwellings per year in Canada’s biggest markets.

Target pace: Doubling that rate would be “ambitious but necessary,” Yönder argues.

Policy levers: The report quantifies that improving municipal approval timelines by 10% could add 3% more housing supply, while reducing regulatory burdens by 10% could add another 10% — all at no cost to governments.

Risks: On the flip side, a 10% increase in building costs could cut completions by as much as 35%, particularly in apartment projects.

Not All Cities Will React the Same Way.

The research also highlights how different housing markets respond to supply and demand:

Toronto & Vancouver: Doubling completions could stabilize prices, but only just.

Montreal: Even major increases in supply won’t stop upward pressure, as affordability gaps with other cities leave “more room” for growth.

Calgary: Prices are more tied to immigration swings than supply, with a recent $740,000 peak expected to cool and remain below that level.

.png)